ABOUT US

關(guān)于我們

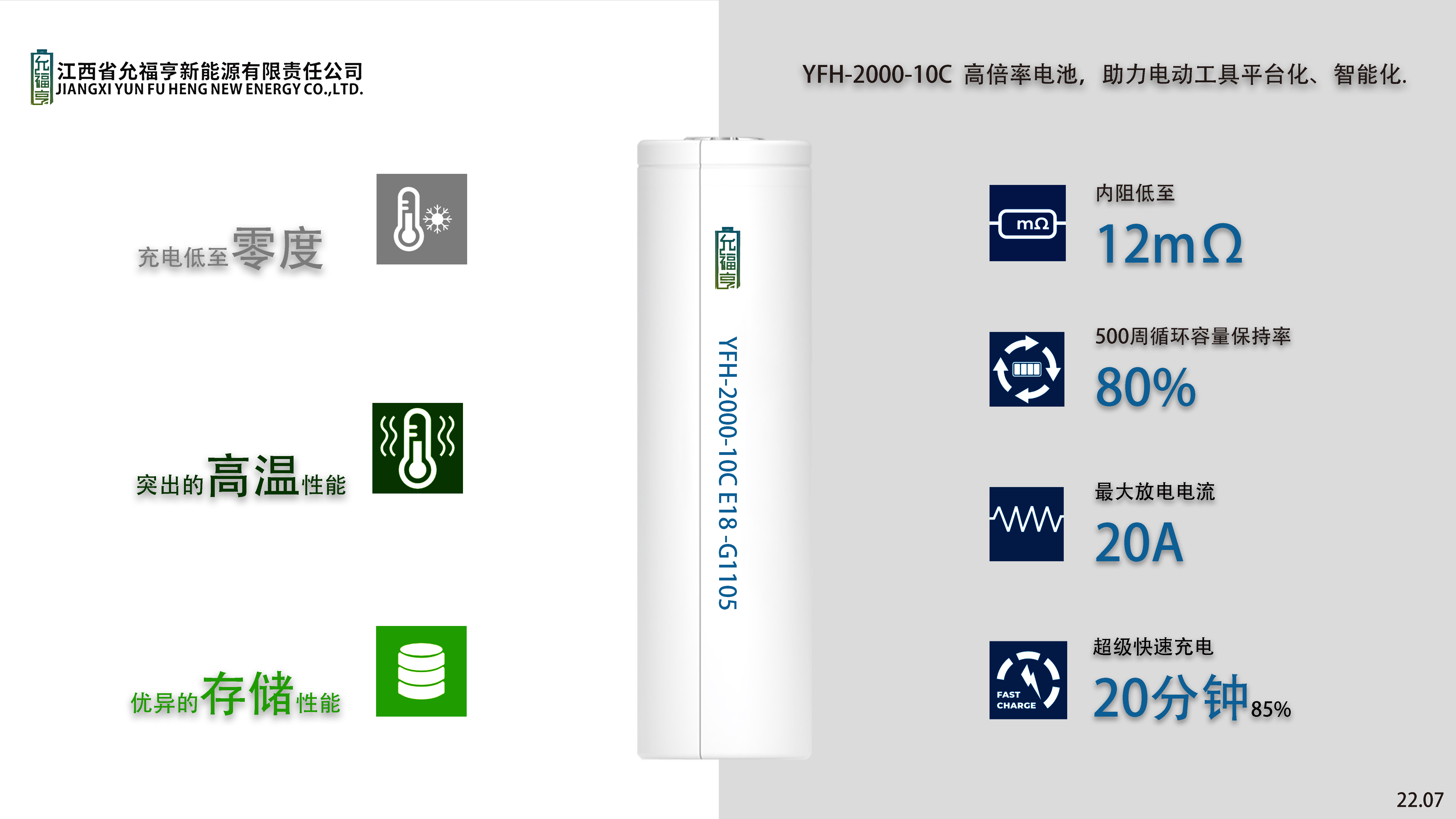

宜春市新恒凱新能源科技有限公司主要經(jīng)營(yíng)鋰離子電池、鋰離子動(dòng)力電池(組)、鋰離子儲(chǔ)能電池(組)、新型電池、電芯、電池材料、電動(dòng)車(chē)輛、電動(dòng)自行車(chē)及相關(guān)產(chǎn)品研發(fā)、設(shè)計(jì)、制造、加工、銷(xiāo)售及相關(guān)服務(wù)。

展望未來(lái),新恒凱將堅(jiān)持“勤勉誠(chéng)信、開(kāi)放共享、創(chuàng)新高效”的企業(yè)核心價(jià)值觀(guān)和“核心聚焦、創(chuàng)新驅(qū)動(dòng)、效益優(yōu)先”的經(jīng)營(yíng)方針,加強(qiáng)與世界領(lǐng)先企業(yè)的戰(zhàn)略合作,繼續(xù)為客戶(hù)提供優(yōu)質(zhì)的產(chǎn)品和服務(wù),矢志成為“具有核心競(jìng)爭(zhēng)力的國(guó)際一流企業(yè)。

NEWS INFORMATION

新聞動(dòng)態(tài)